72 pages • 2 hours read

Andrew Ross SorkinToo Big To Fail

Nonfiction | Book | Adult | Published in 2009A modern alternative to SparkNotes and CliffsNotes, SuperSummary offers high-quality Study Guides with detailed chapter summaries and analysis of major themes, characters, and more.

Chapters 12-16Chapter Summaries & Analyses

Chapter 12 Summary

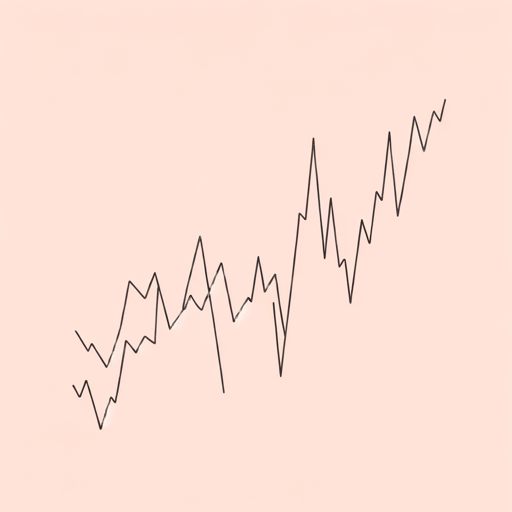

When the news broke that the Korea Development Bank was no longer considering buying Lehman, its stock “dropped precipitously” (234). McDade told Fuld that they should “preannounce earnings before the scheduled earnings call next Thursday” to try to “settle things down” (234). This was mainly a courtesy to Fuld, who had been “stripped […] of any real authority” (235). Ken Wilson at Treasury pressured Fuld to call Bank of America, but Wilson did not tell him that “he had already worked over Greg Curl of Bank of America to tee up the phone call” (243). He warned Fuld indirectly that “he didn’t have much negotiating power—or time” (243). Fuld called Rodgin Cohen and asked him to call Curl. Curl was cautious but said he would “talk to the boss” (244). Curl ended up telling Wilson, however, that Bank of America was having a problem with the Richmond Fed and would need Treasury’s help to clear that up before they could help Lehman, which Wilson relayed to Paulson. That stalled Bank of America’s potential talks with Lehman.

Paulson, meanwhile, was not happy that his Fannie and Freddie announcement had not stabilized the markets and had been met with criticism from Congress.